tn franchise and excise tax guide

Open the form in the online. The Department of Revenue also offers a toll-free franchise and excise tax information line for Tennessee residents.

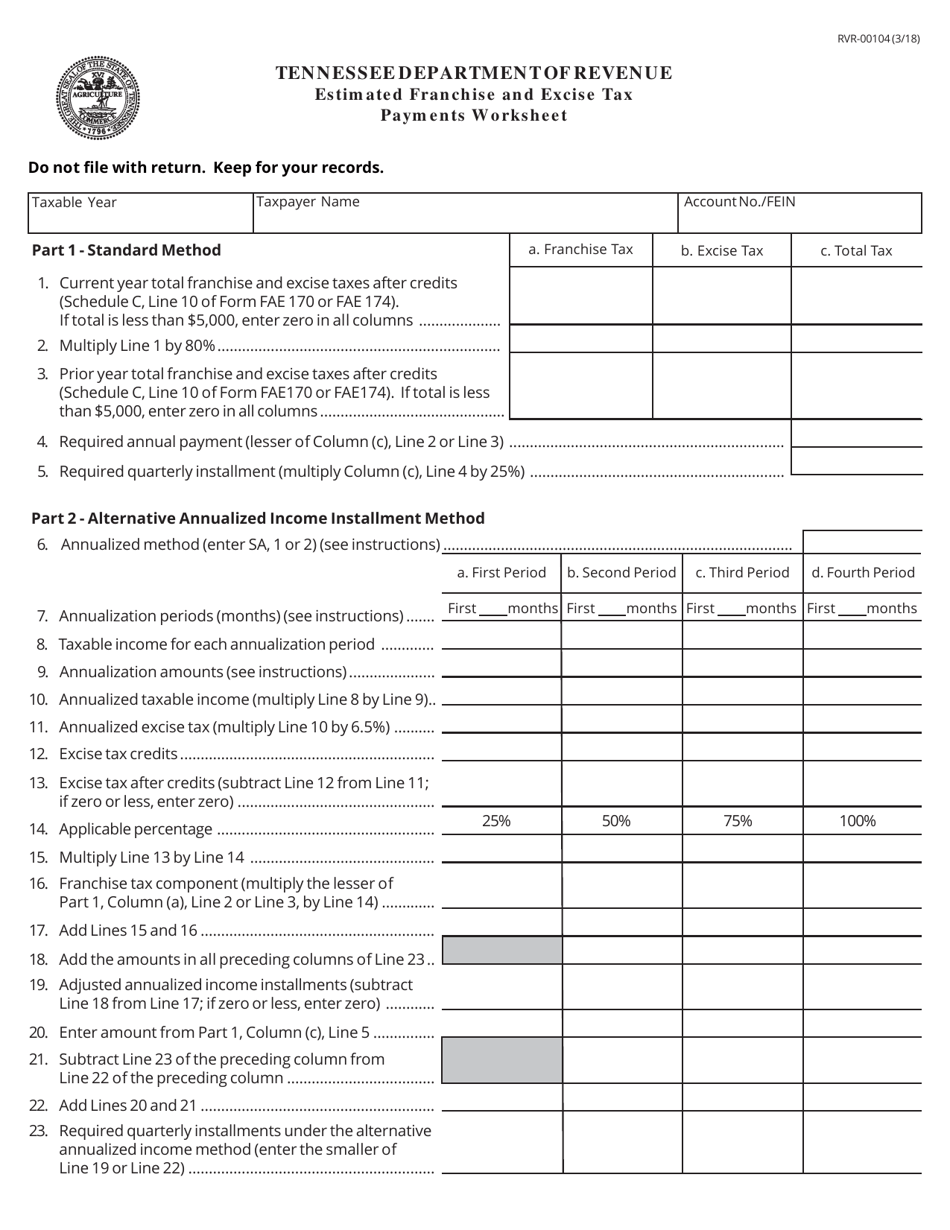

Form Rvr 00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

The franchise and excise.

. Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting. The number is 800 397-8395. Learn about excise tax and how Avalara can help you manage it across multiple states.

Franchise and excise tax components of the quarterly estimates are computed separately. Out-of-state Financial Institutions in. For more information view the topics below.

The franchise and excise tax guide to the vendor relations specialist and inspect confidential or public. Learn about excise tax and how Avalara can help you manage it across multiple states. Election made on the franchise and excise tax return.

FE-7 - The Date an Entity Formed Outside of TN Becomes Subject to the FE Tax FE-8 - Due Date of a Return Covering Less Than 12 Months FE-9 - Extension for Filing the Franchise and. The minimum tax is 100. The excerpts from the Tennessee Code are through the 2020 legislative session.

The franchise tax is computed based on 025 of the greater of net worth or real and tangible property in Tennessee. The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. Tax Manuals The information provided in the Departments tax manuals is general in nature.

TN Franchise Excise Tax 101 contd from front page Now how is the tax calculated. Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee. All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business.

Tennessee franchise and excise tax guide tenn. 025 per 100 based on either the fixed asset or equity of the. The minimum franchise tax is 100.

Tax-exempt Financings in Tennessee b. Excise tax 65 of. Florida manufacturer or franchise and tennessee excise tax guide online.

If calling from Nashville or outside. Excise - computed in accordance with. The excise tax is a 65 tax on the net earnings from business done in Tennessee for the year.

65 excise tax on the net earnings of the entity and. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. FE Credit-1 - Tax Credits are Claimed by the Entity That Earned Them FE Credit.

The excise tax is. The excise tax is 65. Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an estimated payment is deficient or delinquent up to a.

Select the form you need in our library of legal forms. Ad Find out what excise tax applies to and how to manage compliance with Avalara. This publication is designed to help taxpayers better understand the Tennessee franchise and excise taxes including the collection and remittance of the taxes.

Franchise Excise Tax - Credits Tax credits offset tax liability. Franchise Excise Tax - Excise Tax. The Tennessee Franchise and Excise tax has two levels.

Tennessee Franchise Tax Account Number Lookup will sometimes glitch and take you a long time to try different solutions. Ad Find out what excise tax applies to and how to manage compliance with Avalara. Commercial Banking in Tennessee c.

All entities doing business in Tennessee and having a substantial nexus in. Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an. Guide to Doing Business in TN 3 9.

LoginAsk is here to help you access Tennessee Franchise Tax.

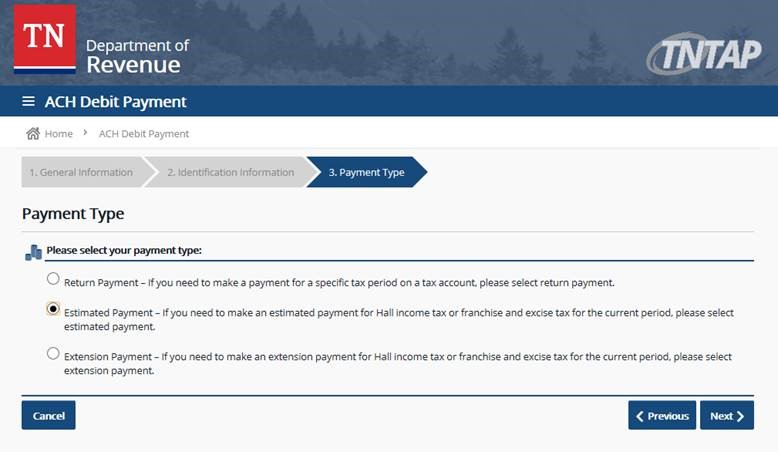

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

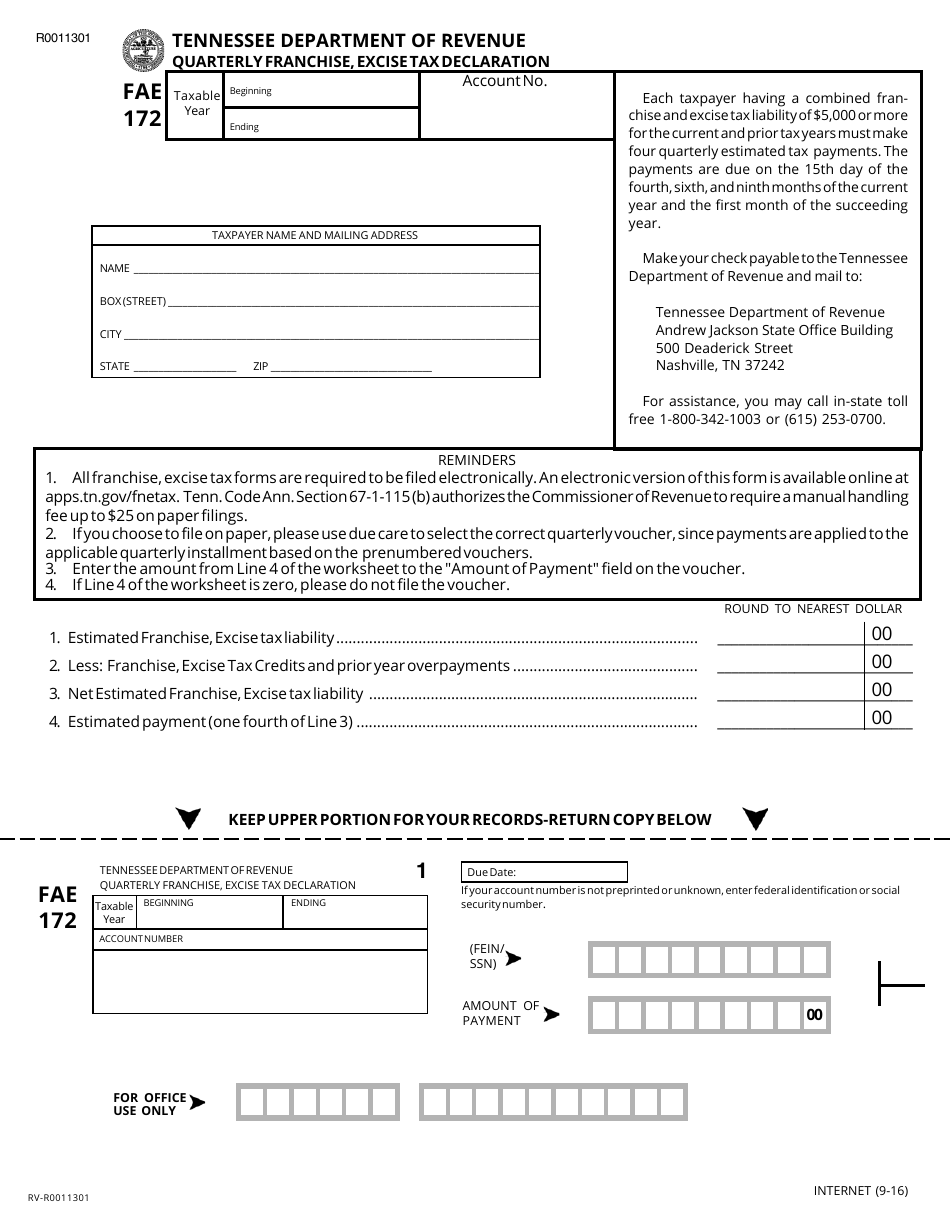

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

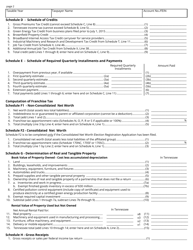

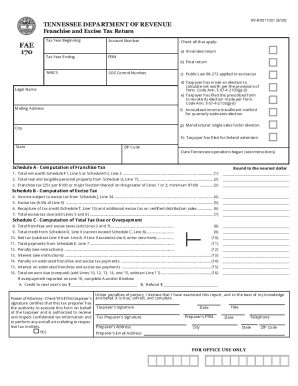

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Ultimate Excise Tax Guide Definition Examples State Vs Federal

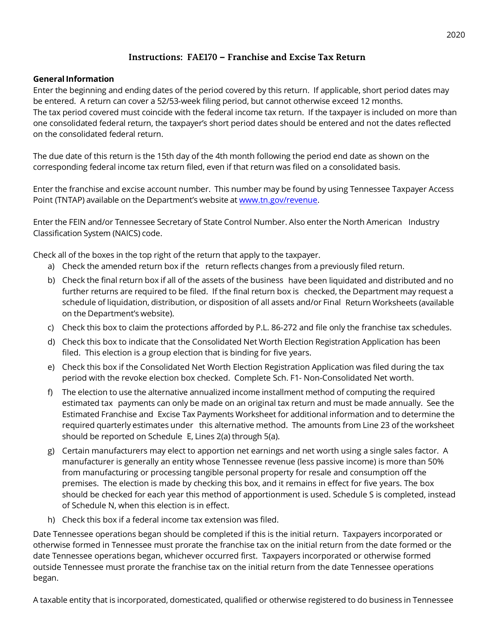

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller

Tennessee Franchise Excise Tax Price Cpas

Tn Franchise Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

Tennessee Franchise And Excise Tax Form Fill Out And Sign Printable Pdf Template Signnow

Franchise Excise Tax Consolidated Net Worth Election Applicaion Youtube